The Euro and the Resilience-Stability Tradeoff

In complex adaptive systems, stability does not equate to resilience. In fact, stability tends to breed loss of resilience and fragility or as Minsky put it, “stability is destabilising”. Although Minsky’s work has been somewhat neglected in economics, the principle of the resilience-stability tradeoff is common knowledge in ecology, especially since Buzz Holling’s pioneering work on the subject. If stability leads to fragility, then it follows that stabilisation too leads to increased system fragility. As Holling and Meffe put it in another landmark paper on the subject titled ‘Command and Control and the Pathology of Natural Resource Management’, “when the range of natural variation in a system is reduced, the system loses resilience.” Often, the goal of increased stability is synonymous with a goal of increased efficiency but “the goal of producing a maximum sustained yield may result in a more stable system of reduced resilience”.

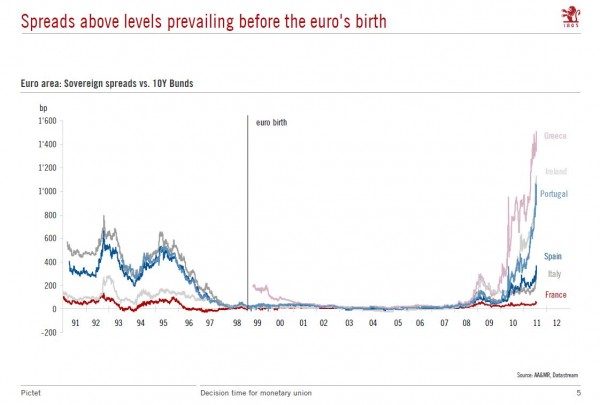

The entire long arc of post-WW2 macroeconomic policy in the developed world can be described as a flawed exercise in macroeconomic stabilisation. But there is no better example of this principle than the Euro currency project as the below graph (from Pictet via FT Alphaville) illustrates.

Instead of a moderately volatile mix of different currencies and interest rates, we now have a mostly stable currency union prone to the occasional risk of systemic collapse. If this was all there is to it, then it is not clear that the Euro is such a bad idea. After all, simply shifting the volatility out to the tails is not by itself a bad outcome. But the resilience-stability tradeoff is more than just a simple transformation in distribution. Economic agents adapt to a prolonged period of stability in such a manner that the system cannot “withstand even modest adverse shocks”. “Normal” disturbances that were easily absorbed prior to the period of stabilisation are now sufficient to cause a catastrophic transition. Izabella Kaminska laments the fact that sovereign spreads for many Eurozone countries (vs 10Y Bunds) now exceed pre-Euro levels. But the real problem isn’t so much that spreads have blown out but that they have blown out after a prolonged period of stability.

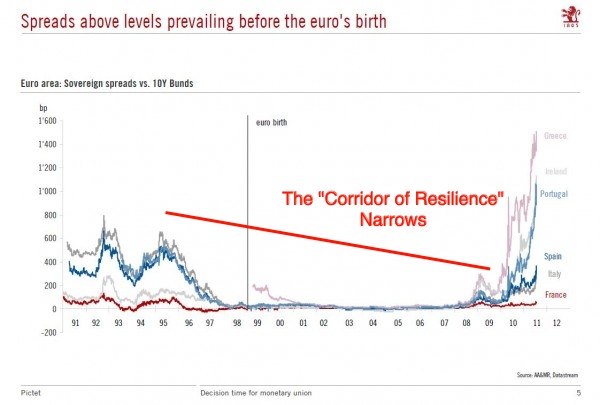

One way to analyse this evolution is via Axel Leijonhufvud’s ‘corridor hypothesis’. Leijonhufvud postulated that a macroeconomy will adapt well to small shocks but “outside of a certain zone or “corridor” around its long-run growth path, it will only very sluggishly react to sufficiently large, infrequent shocks.” In Leijonhufvud’s own view, the driver of this “demand failure” outside the corridor was the “exhaustion of liquid buffers reinforced by dysfunctional revisions of permanent income expectations” Stability reduces the width of the corridor to the point where even a small shock is enough to push the system outside the corridor - the primary driver of this process is a progressive reduction of liquid buffers in the good times such that even a small shock will exhaust them.

In my earlier posts comparing the dilemmas of managing a stabilised economic system to those of a fire-suppressed forest and a flood-suppressed river system, I claimed that managing a stabilised and fragile system is akin to choosing between the frying pan and the fire. Minsky too recognised that the stabilisation program would eventually run into a cul-de-sac where “the choice seems to become whether to accomodate to an increasing inflation or to induce a debt-deflation process that can lead to a serious depression”. What he could not possibly have foreseen is that instead of turning towards the safety valve of inflation, the developed world would instead choose to abandon the goal of full employment. This of course simply chooses social fragility over macroeconomic fragility. The consequences of the abandonment of the Euro project pale in comparison to the forces that may be unleashed by the combination of social fragility via unemployment and a perceived democratic deficit.

Comments

scepticus

Yes I saw that graph today too - very striking it is! You said this: "What he could not possibly have foreseen is that instead of turning towards the safety valve of inflation" I'm not sure the UK or US has rejected inflation. IMO they are just finding it much more difficult than anticipated to create inflation in a way that is actually helpful. Of course this in itself speaks to the fact the stabilisation tools the CBs thought they had are broken. I'd also be interested to hear a statement of what micro or macro structure it is that creates the need for a safety valve in the first place. I don't see much evidence of monetary stabilisation policies in the 19th century but what's this: http://rortybomb.wordpress.com/2011/09/05/labor-day-and-the-creation-of-free-anti-feudalistic-labor-through-regulation/ Hmm, it seems that during what many perceive as the golden age of unstabilised creative destruction there is a horribly insidious stabilisation mechanism that is arguably a good deal more socially damaging than what we have today! Perhaps progress is the replacement of a bad stabilisation mechanism with a less bad one. The question is perhaps what stabilisation mechanism is less bad than the one which has recently failed. Is the abolishment of risk free money the next logical step?

Ashwin

I should have been more specific - what has been rejected IMO is the possibility of wage inflation. The menu of policy options focuses on asset price inflation instead. I think pretty much the entire history of capitalism has been a series of crony capitalist policies trying to pass themselves off as laissez-faire policies. I could be wrong but what I am concerned about is that the current macro structure is too good at allowing capitalists to shelter themselves from the risk of failure. A world without the fiction of a risk-free asset would be less stable but it would be a lot more resilient.

David Pearson

Brillian post, Ashwin. Stability-seeking regimes are so dangerous precisely because they promise to eliminate danger.

Ashwin

David - Thanks. The illusion that risk can be eliminated is a dangerous thing.

K

Ashwin: "The illusion that risk can be eliminated is a dangerous thing." I dunno... I left grad school (long time ago) thinking that my job was to seek alpha from lots of independent sources. It didn't take long to figure out that in the real world the problem isn't as much a lack of alpha as a lack of uncorrelated returns. And as leverage grew over the past decade that has only become more and more apparent. (And in an AD deficient world, of course, correlation only gets even higher.) But... assuming an efficient quantity of aggregate demand, I do wonder how much asset volatility arises from the volatility of the expected value of future output and how much arises from the volatility of the expected share of output going to capital versus labour. As rent seeking rises as a fraction of the economy (witness the rise of finance, natural resources and IP), the value of capital becomes increasingly dependent on the future political power of the rentiers which may to a large extent be a single factor driving most of asset returns. What I'm getting at is that in a world without rents (and with sufficient demand) there might not be that many significant sources of asset correlation and diversification might be extremely powerful in eliminating risk. So maybe an efficient world is not *that* risky.

Ashwin

K - I agree! The operative phrase in your comment is "not that risky". The normal state is not that risky but this low level of risk is a given for even the most diversified player. In our attempt to stamp out all risk from certain parts of the economy (whether as public policy or rent-seeking behaviour or combination of both) we've transformed a system prone to regular "normal" disturbances into one that, after an initial "completely stable" phase, perpetually teeters on the brink of collapse. The day of reckoning can and is being postponed by giving up on full employment instead. The real tragedy is that rent-seeking seems to be accelerating, which leaves me very pessimistic as to the nature of the eventual denouement.

K

Ashwin, what I'm really wondering is, in an efficient economy what are the sources of systemic risk? Why would there be any "normal fluctuations" other than just the sum of a large number of independent risk factors? How big could systemic supply side factors be? And what are the systemic factors in our current dysfunctional system? Obviously there's AD. I think that in an economy where the majority of the value of capital stems from rents, the outlook for rent-seeking is a possibly independent second one. Is there a third factor that relates to accentuated risk due to long duration caused by low rates and reduced risk premia (risk suppression via deliberate public policy)? And should these be viewed as independent systemic factors or do they have the same underlying dynamic?

Ashwin

K - In most scenarios, the "normal" risk won't be very large. But the possibility of endogenous bubbles or supply-side shocks obviously cannot be ruled out completely. IMO even in the absence of special interests and stabilisation, the economic system is fundamentally disorderly in an unpredictable manner - just not to the extent that we perpetually teeter on the brink of collapse. All this implies is that agents in the system will hold sufficient slack and/or be sufficiently diverse such that macro-collapse is an unlikely event. The point I was trying to make in my posts on cronyism starting with https://www.macroresilience.com/2010/11/24/the-cause-and-impact-of-crony-capitalism-the-great-stagnation-and-the-great-recession/ is that the inability to maintain AD/full employment is connected to the dominance of rent-seeking. Minsky appreciated this problem - the repeated interventions to stabilise the system create a fragile AND unfair system. The risk suppression is mostly a policy response to somehow postpone the eventual collapse of the above dynamic. But it too is unsustainable. Every succeeding monetary stimulus has less and less impact and we eventually slouch towards the Japan scenario where real rates again become positive and risk premia recover. Unlike the conventional monetarist and Keynesian view, I think the policymakers understand that if the cronyist status quo is preserved, then we need a lot of inflation to get us back to full employment and this too will be a temporary victory.

The art of failure in cloud’s complex system « Cloud Ecology

[...] for any software system in the cloud is asking for stability. As a recent post about the stability vs reliability tradeoff (in the context of economics) makes quite clear, stability doesn’t work out quite the way [...]