House Prices, The Wealth Effect And Crony Capitalism

As I illustrated in a previous post, “a significant proportion of the balance sheet of wealthy Americans is made up of real assets – real estate, stock and business holdings”. Therefore “what wealthy Americans, businesses and banks share is a common interest in supporting asset prices (real and nominal), a lack of interest in seeking full employment unless it is a prerequisite for supporting asset prices, and an aversion to any policies that can trigger wage inflation”. The fact that our dominant macroeconomic policy doctrine depends upon the ‘wealth effect’ simply reflects the fact that our economy is driven by wealthy special interests.

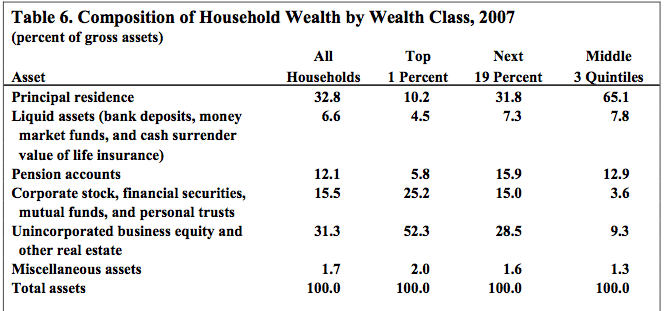

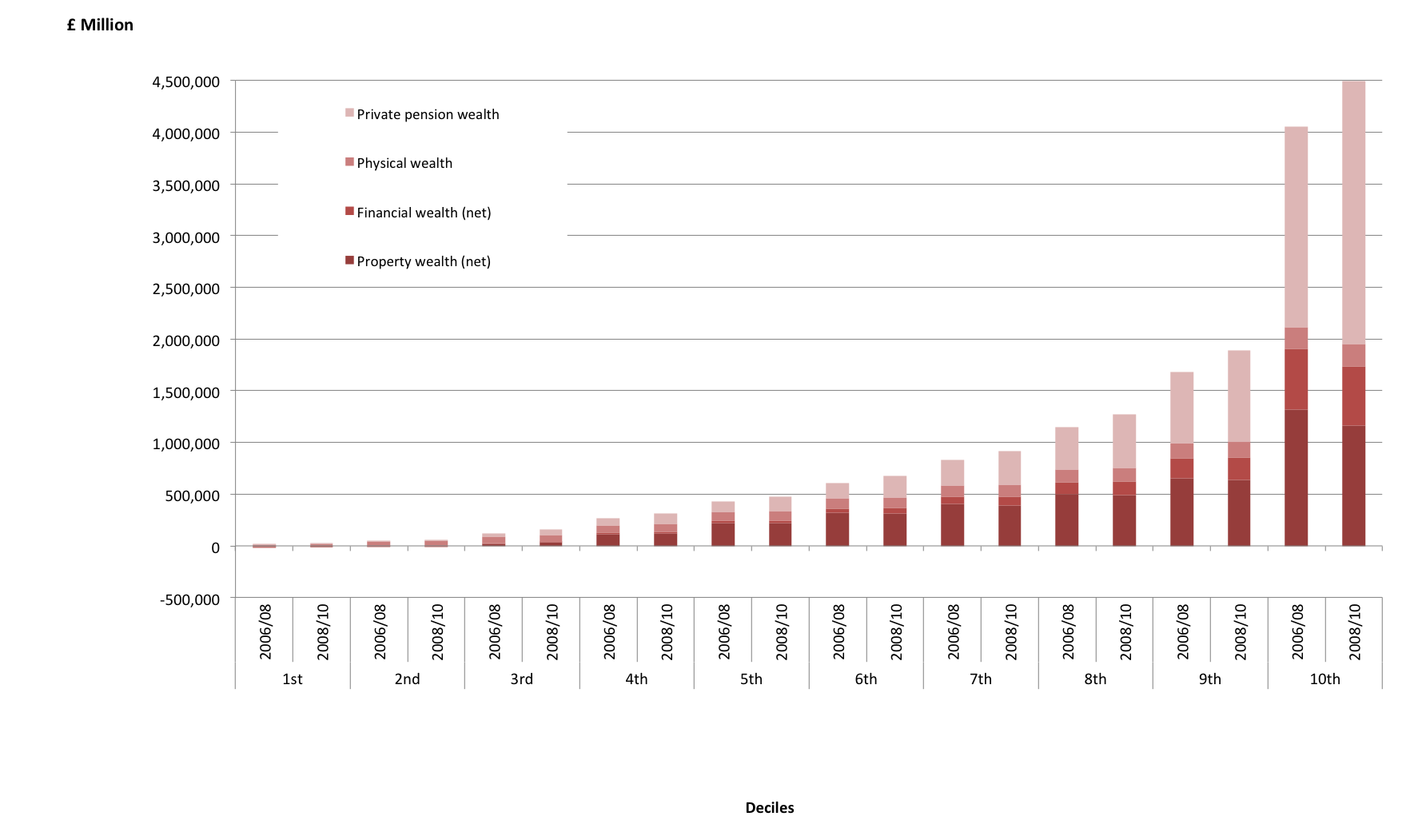

The real question again is why there isn’t more mass opposition to such a blatantly regressive policy regime. In previous posts(1, 2), I have argued that crony capitalism achieves broad-based support by piggybacking upon broad-based programs aimed at the middle class. But they also achieve this support due to the absence of a safety net that breeds middle-class insecurity. This carrot-and-stick approach ensures middle-class support for the same stabilising policies that transfer wealth to the one percent. As the table below (taken from Edward Wolff’s paper) shows, the most significant asset holding of the middle class in the United States is their principal residence. The data is no different in the United Kingdom (table below from the ONS). Supporting house prices therefore is the sop that special interests need to provide to the middle class in order to ensure their support for the ‘wealth effect’-driven economy.

[caption id="" align="aligncenter" width="664"] Household Wealth Distribution In The United States[/caption]

Household Wealth Distribution In The United States[/caption]

[caption id="" align="aligncenter" width="674"] Household Wealth Distribution in the United Kingdom[/caption]

Household Wealth Distribution in the United Kingdom[/caption]

Although there are many instances of direct subsidies to middle-class households via cheaper mortgages (George Osborne’s latest policy being yet another example), these are dwarfed by the impact of the primary guiding principle of macroeconomic policy throughout the neo-liberal era - house prices must keep going up. Rising house prices don’t just act as a carrot to the home-owning middle classes. The fear of being left behind and being out priced by a rising market also acts as a stick to those who don't own homes. Again, middle-class support for the crony capitalist plutocracy is driven by the stick as much as it is by the carrot. Those who “fear” that the latest housing scheme “risks driving up prices” should realise that the increase in house prices is not an unintended consequence but the primary aim of our crony capitalist policy regime.

Comments

Agog

(The last link is broken) That UK plot is really nice - showing roughly how many baskets the middle British deciles have their eggs in (answer: not many).

Ashwin

Agog - fixed. Thanks! Yep - not completely shocking. property really is the only significant investment of most middle-class British families.

oldcobbler

What about other countries ? In countries with a lower-level of owner-occupation (such as Germany) is wealth held in different forms or is there simply less household wealth ? Has there ever been a society in which middle-class households hold substantial wealth in forms other than property ?

Ashwin

oldcobbler - my understanding of an economy like Germany is that there is simply less household wealth http://www.bruegel.org/nc/blog/detail/article/1053-wealth-distribution-in-the-eurozone/#.UVqkHqsjqJM . And obviously this may also connected to the existence of a robust social security system and the need for less wealth.

oldcobbler

I'm not sure where I'm going with this, but looking at, for example, http://epp.eurostat.ec.europa.eu/statistics_explained/index.php/Housing_statistics, the U.K. doesn't appear to have an exceptionally high level of owner occupation by European standards, and I guess that it may also not be exceptional in the percentage of wealth held by the middle classes in the form of property. So, does that imply by the logic of your post that crony capitalism is fairly ubiquitous throughout Europe ? Or do you need other evidence to show the USA and UK are indeed different ?

Burbujas | La Ruta Inconsciente

[...] MacroResilience continúan diseccionando los mecanismos del crony capitalism norteamericano, y proporcionando [...]

Ashwin

oldcobbler - I'm not really saying that concentration of household wealth in property is a sign of crony capitalism. I'm saying that obsessive support of house prices and mortgage availability by the government (controlled by special interests) is a sign of crony capitalism. It is the existence of entities such as Fannie/Freddie and the mortgage subsidy scheme that differentiate the US and the UK.

Enlaces compartidos

[...] House Prices, The Wealth Effect And Crony Capitalism [...]

oldcobbler

Apologies for labouring this point, but given the special support for housing in the U.S.A. and UK to which you refer, I would intuitively expect the proportion of household wealth held in the form of housing to be much higher in the UK and the US to be larger than in other countries. But, in so far as one can tell from the limited data, this doesn't seem to be the case. See, for example, Table 2 in http://economics.uwo.ca/faculty/davies/workingpapers/thelevelanddistribution.pdf. So, although I recognise there are loads of different factors involved, I suppose I'm questioning whether the UK and US are quite as different from other economies as you suggest. No more comments, I promise !

Mark

In 2006, I toyed with the idea of buying a flat in London. However, I became convinced that the housing market was a house of cards and would soon topple as present (then) house prices could not be supported by demand. How wrong I was. I have since realised that house prices are supported by government policy as they are a key post of metropolitan culture and social stability. If houses prices halved in urban centres, there would be rioting in the streets!

Ashwin

oldcobbler - well I don't disagree. From the perspective of housing wealth, Germany is probably different but the rest of Europe certainly is not. The only way they are different is the obsessive focus on house prices from the government and the central bank. Mark - London itself also benefits from global safe haven flows so it is very disconnected from the rest of the UK. If house prices halved in London, the UK would be in a recession for a very long time as well!