Monetary Policy and Financial Markets: A "Real Rates" Lens

In recent years, central banks on both sides of the Atlantic have implemented a raft of monetary policy initiatives that many people view as having no precedent in history. This opinion is understandable when compared to recent history - During the Great Moderation, monetary policy was largely restricted to adjustments in short-term nominal rates. But when viewed in the context of the longer history of fiat currency monetary policy, almost every policy implemented by central banks during this crisis has a historical precedent. In this post, I analyse fiat currency monetary policy (conventional or unconventional) as an attempt to influence the real interest rate curve under the constraint of inflation and employment/GDP targets - this is not intended to be a comprehensive theory, simply a lens that I find useful in analysing the impact of monetary policy.

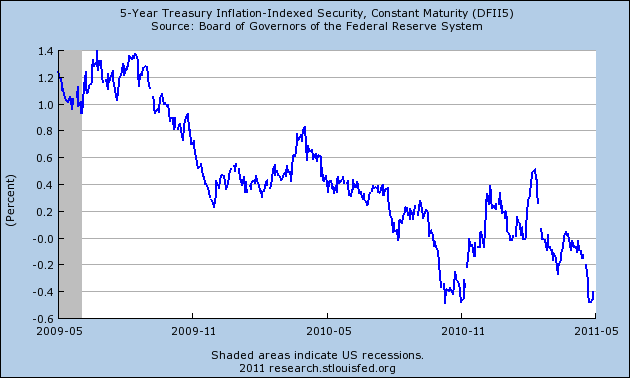

The primary dilemma faced by governments today is the tension between the need to rein in government indebtedness in the long run and stimulate economic growth in the short run. The task of stimulating growth is complicated by the high levels of consumer indebtedness. There are no easy solutions to this problem - reducing government indebtedness itself is critically dependent upon maintaining economic growth i.e. ensuring that the GDP in the debt/GDP ratio grows at a healthy rate. In the fiat currency era (post 1945), one solution has usually been preferred to all others - the enforcement of prolonged periods of low or even negative real interest rates. In an excellent paper, Carmen Reinhart and Belen Sbrancia have analysed the role of “financial repression” in engineering negative real interest rates and reducing real government debt burdens between 1945 and 1980. Given the similarity of our current problems to the post-WW2 situation, it is no coincidence that a reduction in real rates has been a key component of central banks' response to the crisis.

As Paul Krugman notes, the textbook monetary policy response to a liquidity trap requires that central banks “credibly promise to be irresponsible…to commit to creating or allowing higher inflation…so as to get negative real interest rates”. In the context of the current crisis, the central bank response has involved two distinct phases. In the first phase of the crisis, the priority is to prevent a deflationary collapse. Short of untested schemes that try to enforce negative nominal rates, deflation is inconsistent with a reduced real interest rate. In trying to mitigate the collapse, short rates were rapidly reduced to near-zero levels but equally critically, a panoply of “liquidity” programs were introduced to refinance bank balance sheets and prevent a collapse in shadow money supply. It is fair to critique the expansion of the Fed balance sheet for the backdoor bailout and resulting incentive problems it engenders in the financial sector. But in purely monetary terms, the exercise simply brings hitherto privately funded assets into the publicly funded domain.

Even after the deflationary collapse had been averted, simply holding short rates at zero and even a promise to hold rates at near-zero levels may be insufficient to reduce real rates sufficiently at the long end of the treasury curve. The market may simply not believe that the central bank is being credible when it promises to be “irresponsible”. Therefore the focus shifts to reducing the interest rates on longer-dated government bonds or even chosen risky assets via direct market purchases - MBS in the case of QE1 but there is no reason why even corporate bonds and equities could not be used for this purpose. If a fiat-currency issuing central bank does not care about inflation, it can enforce any chosen nominal rate at any maturity on the risk-free yield curve. Of course, in reality, central banks do care about inflation and therefore, instead of phrasing QE as a binding yield target, central banks limit themselves by the quantity of long-term bonds bought. As Perry Mehrling notes, QE2 is most similar to war finance and differs only in the choice of a quantity rather than a yield target. During WW2 the Fed essentially fixed the price of the entire government bond yield curve. Perry Mehrling describes it well in his excellent book: “Throughout the war, the interest rate on Treasury debt was fixed at 3/8 percent for three-month bills and between 2 and 2½ percent for long-term bonds, and it was the job of the Fed to support these prices by offering two-way convertibility into cash…it was not until the Fed-Treasury Accord of March 1951 that the Fed was released from its wartime responsibility to peg the price of government debt.” The Fed-Treasury accord in 1951 that signalled the end of this phase was a consequence of an outbreak of inflation brought upon by the Korean War.

Arbitrage and Negative Real Rates

The textbook arbitrage response to ex-ante negative real rates is to buy and store the goods comprising one’s future consumption basket. In the real world, this is often not a realistic option and negative real rates can prevail for significant periods of time. This is especially true if inflation only exceeds risk-free rates by small amounts. Maintaining risk-free rates at low levels while running double-digit inflation levels risks demonetisation and hyperinflation but a prolonged period of small negative real rates may achieve the dual objective of growth and reduced indebtedness without at any point running a significant risk of demonetisation. So long as the central bank’s “pocket picking” is not too aggressive, the risk of demonetisation is slim.

As Reinhart and Sbrancia note, the option of enforcing negative real rates was available in the post-1945 environment only because “debts were predominantly domestic and denominated in domestic currencies.” Therefore although the US and Britain may try to follow the same policy again, it is clear that this option is not available to the peripheral economies in the Eurozone. Reinhart and Sbrancia argue that “inflation is most effective in liquidating government debts (or debts in general), when interest rates are not able to respond to the rise in inflation and in inflation expectations. This disconnect between nominal interest rates and inflation can occur if: (i) the setting is one where interest rates are either administered or predetermined (via financial repression, as described); (ii) all government debts are fixed- rate and long maturities and the government has no new financing needs (even if there is no financial repression the long maturities avoid rising interest costs that would otherwise prevail if short maturity debts needed to be rolled over); and (iii) all (or nearly all) debt is liquidated in one “surprise” inflation spike.” Condition (ii) is not satisfied in either the US or Europe whereas attempting to liquidate debt with one surprise inflation spike risks losing the credibility that central banks have fought so hard to acquire. Which leaves only option (i).

But even if investors cannot store their future consumption basket, could they simply not move into commodities or currencies with higher real rates of return? As James Hamilton notes, “there’s an incentive to buy and hold those goods that are storable…..episodes of negative real interest rates have usually been associated with rapidly rising commodity prices.” But the investment implications of negative real rates regimes are not quite so straightforward.

Implications for Financial Markets and Investment Strategies

In Reinhart and Sbrancia’s words, “inflation is most effective in liquidating government debts when interest rates are not able to respond to the rise in inflation and in inflation expectations.” If interest rates track the rise in inflation and real rates are positive, then a risk-averse investor simply needs to be invested in short-duration bonds (e.g. floating rate bonds) to preserve his purchasing power. In countries such as Australia, floating-rate bonds and short-duration bonds may preserve purchasing power in the same manner that inflation linkers can. But this does not hold for a countries such as the United States or the United Kingdom where real rates at the short-end are negative. Ex-ante negative real interest rates ensure that there is no “risk-free” asset in the market that can preserve one’s purchasing power. As Bill Gross notes: "bond prices don’t necessarily have to go down for savers to get skunked during a process of debt liquidation." The logical response is to move to real assets or, as Bill Gross suggests, "developing/emerging market debt at higher yields denominated in non-dollar currencies" with a positive real interest rate. But as always, there are no free lunches.

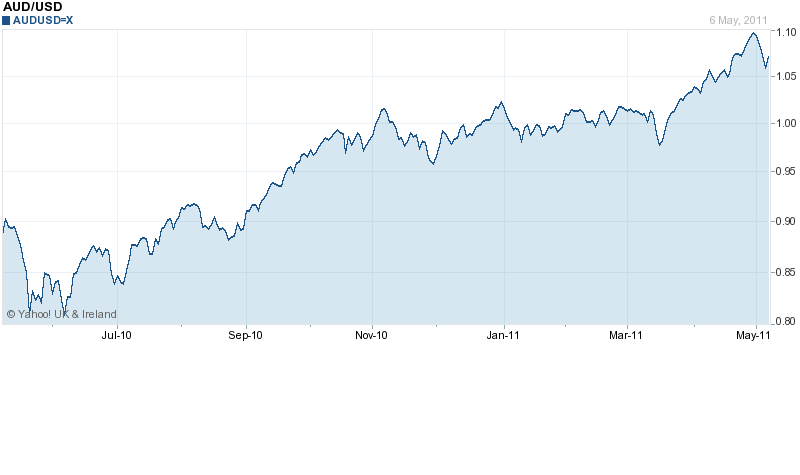

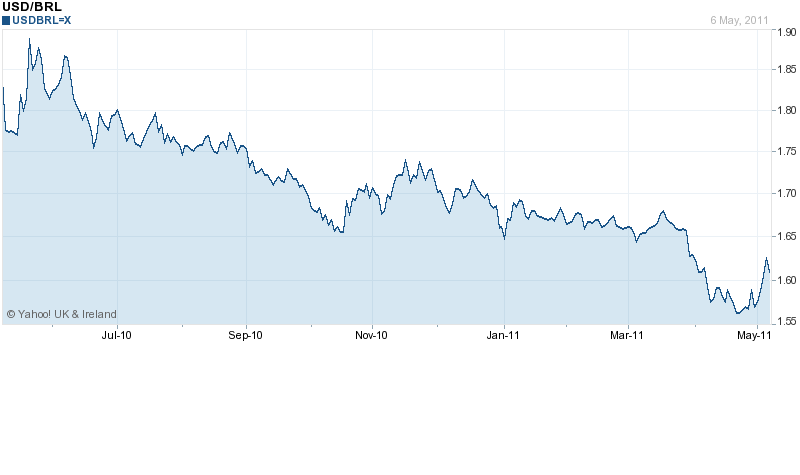

Let’s assume that the market expects no “real rate suppression” to start with and the Fed surprises the market with an announcement that it intends to suppress the rate to the extent of 20% over the next decade. Assuming that Australian and Brazilian monetary and fiscal policy expectation remains unchanged by this announcement, the market should immediately revalue the Australian Dollar (AUD) and the Brazilian Real (BRL) upwards by 20%, a revaluation that it will give back over the next decade. Anyone who invests in either currency afterwards will not earn a superior return to what is available to him in USD. This idealised example makes many assumptions e.g. currency parity, ignores risk premiums and abstracts away from uncertainty. But the point that I am trying to make is simply this: Once real rate suppression has commenced, all asset prices will necessarily adjust to reflect the expected amount of suppression. Even a cursory look at the extent of recent appreciation in AUD or BRL tells us that much of this adjustment may have already taken place. In other words, there is no free lunch in moving away from USD to any other asset - an investment in real assets or foreign currency bonds only makes sense if one believes that the actual extent of suppression will exceed the current estimate.

Risk premiums will not change the above analysis in any meaningful manner. The idea that one can earn higher returns simply by turning up a “risk” dial is tenuous at the best of times but in the absence of a truly risk-free asset that preserves purchasing power, the very idea of a “risk premium” is meaningless. In the language of Kahneman and Tversky, it is the category boundary between certainty and uncertainty that matters most to an investor.

But the key difference between the above idealised example and the real world is the uncertainty about the extent and the pace of real rate suppression that a central bank will follow through with. The critical source of this uncertainty is the inflation and employment target that guides the central bank. The central bank may change its plans midway for a variety of reasons - a spike in inflation may put pressure on it to hike rates even if growth remains sluggish, a revival in real GDP growth may also allow it to unwind the program early. Even worse, inflation may slip below target despite the CB’s best efforts to stimulate investment and consumption demand i.e. the Japan scenario.

The expectation and distribution of real rate suppression influences the valuation of every asset price and the changes in this expectation and distribution become a significant source of market volatility across asset classes. What is also clear that for many real assets and foreign currency bonds, the present scenario where the economy muddles through without falling into either the Japan scenario or managing a strong recovery is the “best of all worlds”. To put it in the language of derivatives, if we define the amount of “real rate suppression” as the risk variable, then many real assets represent a “short volatility” trade. Obviously, this does not take into account the sensitivity of some of these assets to the economic conditions but this does not make it irrelevant even for assets such as US equities. The expected valuation uplift in equities from a strong economy may easily be at least partially negated by the reduced expectation of real rate suppression. This also illustrates how a jobless recovery that doesn’t turn into the Japan scenario is the ideal environment for equities. So long as monetary policy is guided by the level of employment, GDP growth without a pickup in employment maximises the expectation of rate suppression and by extension, the valuation of equity markets.

Comments

Tuesday links: changing course | Abnormal Returns

[...] What is a risk premium in a world of negative real interest rates? (Macroeconomic Resilience) [...]

pce

I wondered how you fit this post in with the Caballero narrative - that the world has been suffering from an excess demand for safe liquid assets for at least a decade. As the wealth of the EMs grew, they lacked a "parking lot" for their savings due to financial repression / insecure property rights at home. So they looked to the US capital markets. This excess demand pushed down the real interest rate on safe assets. To what extent is Fed low interest rate policy simply "following the market" ?

Ashwin

pce - you can make this argument for the pre-QE long bond market. But regardless of the demand for safe assets from other agents, QE2 represents an incremental source of demand. And on the short end, I'm not sure how we can even define a market for something that is so clearly controlled by the Fed.

Negative Real Interest Rates and the Risk Premium at Macroeconomic Resilience

In my post on monetary policy and real rates, I made a provocative assertion: “in the absence of a truly [...]

Steve Roth

I find this post problematic because it repeatedly refers to "assets" without distinguishing between real and financial assets. I would like to suggest that the language used here: "financial repression" and "pocket picking" betrays the biases of holders of financial assets. ("Creditors" -- since every financial asset is a loan; as Randall Wray has explained so well, the only way to store/"save" money is to lend it.) I suggest more neutral, and I would say accurate, terminology: financial or monetary redistribution. Higher inflation (associated with low/negative real interest rates) decreases the value of financial assets relative to real assets. (Real assets not just including the NIPAs' tangible "fixed assets" -- structures, hardware, software -- but knowledge, skills, organizational capital, natural resources, etc.) In more familiar terms, inflation (and low/negative real rates) transfers value from creditors to debtors. I prefer the financial-versus-real assets description, as it reverses the direction of the implicit moralizing: Creditors good, or real asset holders good?

Ashwin

Steve - I'm referring to real assets only as opposed to nominal assets i.e. those assets which have some form of inflation hedge built in. It doesn't really matter whether they're financial or physical. Only exception being that I'm also including nominal assets in other currencies which depending on the central bank policy in those countries can act like a real asset even though technically they're nominal. Can I also clarify that I tried pretty hard to avoid any moralising in this post - if you detect any, then obviously I didn't do a good enough job. My intention is simply to draw out the implications for markets for the policy that in my opinion the central banks in the US and UK are following. And more specifically to prove that there's no obvious free lunch by buying commodities or gold or anything else. Specifically, my intention was to show by a no-arbitrage argument that for real assets to outperform nominal assets, the CB must create a higher quantity of real rate suppression than is implicitly expected by the market already. Most people in my opinion seem to neglect this subtlety. The term "financial repression" is borrowed from Reinhart and Rogoff and "pocket-picking" from Bill Gross' letter. I agree that they're not very neutral terms. I prefer to call it real rate suppression instead which is what I see as the primary channel through which central banks are trying to effect economic growth and govt indebtedness. I'm not concerned with the "morals" of this policy, simply whether it will deliver the same results as in the 50s. I'm skeptical and I'll try and thrash out this argument in a later post.

Steve Roth

Thanks for the reply. I definitely didn't mean to suggest that you intended to moralize; was referring to Reinhart, Rogoff, and Gross. But even "rate suppression," in the current rhetorical environment carries negative moral valences. I'm just suggesting that we should perhaps be attaching positive valences to the behavior instead. Contra even Krugman, committing credibly to stably higher inflation (3-4%) and continued low real rates could constitute very responsible behavior.

Ashwin

Steve - agreed. I think Gross intended the negative connotation. Reinhart and Rogoff are probably borrowing it from the emerging markets context where "financial repression" is an established term.And I think it's difficult to come up with a term that sounds neutral to all - suppression was the best I could do. Even your choice of monetary redistribution will sound like anathema to some!

The Influence of Special Interests and Rentiers on Monetary and Fiscal Policy at Macroeconomic Resilience

[...] is best achieved by an exclusive reliance on monetary policy – as I discussed in a previous post, a combination of “liquidity” facilities to prevent a collapse in shadow money supply and open [...]

The Great Divide between Academics and Practitioners at Macroeconomic Resilience

[...] Herbert Simon’s terminology, practitioners are satisficers, not optimisers. In a recent post, I outlined my preferred framework to analyse monetary policy as an attempt to influence the real [...]

Collaboration among academics and practitioners can fix economics | The Great Debate

[...] Herbert Simon’s terminology, practitioners are satisficers, not optimisers. In a recent post, I outlined my preferred framework to analyse monetary policy as an attempt to influence the real [...]

Operation Twist and the Limits of Monetary Policy in a Credit Economy at Macroeconomic Resilience

[...] savings, all bound together in the virtuous cycle of the multiplier. As I discussed in a previous post, QE2 and now Operation Twist are not as unconventional as they seem. They simply apply the logic of [...]

Operation Twist and the Limits of Monetary Policy in a Credit Economy « onglobalisation.com

[...] savings, all bound together in the virtuous cycle of the multiplier. As I discussed in a previous post, QE2 and now Operation Twist are not as unconventional as they seem. They simply apply the logic of [...]