The Case Against Monetary Stimulus Via Asset Purchases

Many economists and commentators blame the Federal Reserve for the increasingly tepid economic recovery in the United States. For example, Ryan Avent calls the Fed’s unwillingness to further ease monetary policy a “dereliction of duty” and Felix Salmon claims that “we have low bond yields because the Fed has failed to do its job”. Most people assume that the adoption of a higher inflation target (or an NGDP target) and conventional quantitative easing (QE) via government bond purchases will suffice. Milton Friedman, for example, had argued that government bond purchases with “high-powered money” would have dragged Japan out of its recession. But how exactly is more QE supposed to work in an environment when treasury bonds are trading at all-time low yields and banks are awash in excess reserves?

If we analyse monetary policy as a threat strategy, then how do we make sure that the threat is credible? According to Nick Rowe, “The Fed needs to communicate its target clearly. And it needs to threaten to do unlimited amounts of QE for an unlimited amount of time until its target is hit. If that threat is communicated clearly, and believed, the actual amount of QE needed will be negative.” In essence, this is a view that market expectations are sufficient to do the job.

Expectations are a large component of how monetary policy works but expectations only work when there is a clear and credible set of actions that serve as the bazooka(s) to enforce these expectations. In other words, what is it exactly that the central bank threatens to do if the market refuses to react sufficiently to its changed targets? It is easy to identify the nature of the threat when the target variable is simply a market price, e.g. an exchange rate vs another currency (such as the SNB’s enforcement of a minimum EURCHF exchange rate) or an exchange rate vs a commodity (such as the abandoning of the gold standard). But when the target variable is not a market price, the transmission mechanism is nowhere near as simple.

Scott Sumner would implement an NGDP targeting regime in the following manner:

First create an explicit NGDP target. Use level targeting, which means you promise to make up for under- or overshooting. If excess reserves are a problem, get rid of most of them with a penalty rate. Commit to doing QE until various asset prices show (in the view of Fed officials) that NGDP is expected to hit the announced target one or two years out. If necessary buy up all of Planet Earth.

Interest on Reserves

Small negative rates on reserves or deposits held at the central bank are not unusual. But banks can and will pass on this cost to their deposit-holders in the form of negative deposit rates and given the absence of any better liquid and nominally safe investment options, most bank customers will pay this safety premium. For example, when the SNB charged negative rates on offshore deposits denominated in Swiss Franc in the mid-1970s, the move did very little to stem the inflow into the currency.

Significant negative rates are easily evaded as people possess the option to hold cash in the form of bank notes. As SNB Vice-Chairman Jean-Pierre Danthine notes:

With strongly negative interest rates, theory joins practice and seems to lead to a policy of holding onto bank notes (cash) rather than accounts, which destabilises the system.

Quantitative Easing: Government Bonds

Conventional QE can be deconstructed into two components: an exchange of money for treasury-bills and an exchange of treasury-bills for treasury-bonds. The first component has no impact on the market risk position of the T-bill holder for whom deposits and T-bills are synonymous in a zero-rates environment. But it is also irrelevant from the perspective of the banking system unless the rate paid on reserves is significantly negative (which can be evaded by holding bank notes as discussed above).

The second component obviously impacts the market risk position of the economy as a whole. It is widely assumed that by purchasing government bonds, the central bank reduces the duration risk exposure of the market as a whole thus freeing up risk capacity. But for most holders of government bonds (especially pension funds and insurers), duration is not a risk but a hedge. A nominal dollar receivable in 20 years is not always riskier than a nominal dollar receivable today - for those who hold the bond as a hedge for a liability of a nominal dollar payable in 20 years, the dollar receivable today is in fact the riskier holding. More generally the negative beta nature of government bonds means that the central bank increases the risk exposure of the economy when it buys them.

Apart from the market risk impact of QE, we need to examine whether it has any impact on the liquidity position of the private economy. In this respect, neither the first or the second step has any impact for a simple reason - the assets being bought i.e. govt bonds are already safe collateral both in the shadow banking system as well as with the central bank itself. Therefore, any owner of government bonds can freely borrow cash against it. The liquidity preference argument is redundant in differentiating between deposits and an asset that qualifies as safe collateral. Broad money supply is therefore unaffected when such an asset is purchased.

If conventional QE were the only tool in the arsenal, announcing higher targets or NGDP targets achieves very little. The Bank of England and the Federal Reserve could buy up the entire outstanding stock of govt bonds and the impact on inflation or economic growth would be negligible in the current environment.

Credit Easing and More: Private Sector Assets

Many proponents of NGDP targeting would assert that limiting the arsenal of the central bank to simply treasury bonds is inappropriate and that the central bank must be able to purchase private sector assets (bonds, equities) or as Scott Sumner exhorts above “If necessary buy up all of Planet Earth”. There is no denying the fact that by buying up all of Planet Earth, any central bank can create inflation. But when the assets bought are already liquid and market conditions are not distressed, buying of private assets creates inflation only by increasing the price and reducing the yield of those assets i.e. a wealth transfer from the central bank to the chosen asset-holders. As with quantitative easing through government bond purchases, the inability to enforce adequate penalties on reserves nullifies any potential “hot potato” effect.

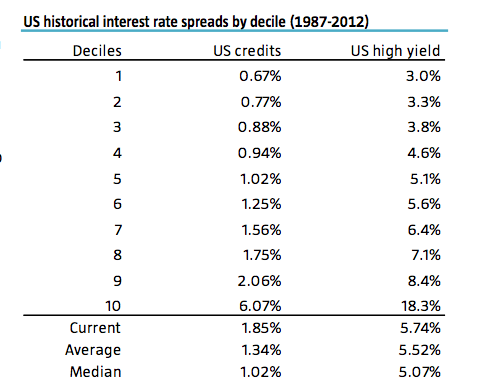

Bernanke himself has noted that the liquidity facility interventions during the 2008-2009 crisis and QE1 were focused on reducing private market credit spreads and improving the functioning of private credit markets at a time when the market for many private sector assets was under significant stress and liquidity premiums were high. The current situation is not even remotely comparable - yields on private credit instruments are at relatively elevated levels compared to historical median spreads but the difference in absolute terms is only about 50 bps on investment-grade credit (see table below) as compared to much higher levels (at least 300-40 bps on investment grade) during the 2008-2009 crisis.

A quantitative easing program focused on purchasing private sector assets is essentially a fiscal program in monetary disguise and is not even remotely neutral in its impact on income distribution and economic activity. Even if the central bank buys a broad index of bonds or equities, such a program is by definition a transfer of wealth towards asset-holders and regressive in nature (financial assets are largely held by the rich). The very act of making private sector assets “safe” is a transfer of wealth from the taxpayer to some of the richest people in our society. The explicit nature of the central banks’ stabilisation commitment means that the rent extracted from the commitment increases over time as more and more economic actors align their portfolios to hold the stabilised and protected assets.

Such a program is also biased towards incumbent firms and against new firms. The assumption that an increase in the price of incumbent firms’ stock/bond price will flow through to lending and investment in new businesses is unjustified due to the significantly more uncertain nature of new business lending/investment. This trend has been exacerbated since the crisis and the bond market is increasingly biased towards the largest, most liquid issuers. Even more damaging, any long-term macroeconomic stabilisation program that commits to purchasing and supporting macro-risky assets will incentivise economic actors to take on macro risk and shed idiosyncratic risk. Idiosyncratic risk-taking is the lifeblood of innovation in any economy.

In other words, QE is not sufficient to hit any desired inflation/NGDP target unless it is expanded to include private sector assets. If it is expanded to include private sector assets, it will exacerbate the descent into an unequal, crony capitalist, financialised and innovatively stagnant economy that started during the Greenspan/Bernanke put era.

Removing the zero-bound

One way of getting around the zero-bound on interest rates is to simply abolish or tax bank note holdings as Willem Buiter has recommended many times:

The existence of bank notes or currency, which is an irredeemable ‘liability’ of the central bank – bearer bonds with a zero nominal interest rate – sets a lower bound (probably at something just below 0%) on central banks’ official policy rates.

The obvious solutions are: (1) abolishing currency completely and moving to E-money on which negative interest rates can be paid as easily as zero or positive rates; (2) taxing holdings of bank notes (a solution first proposed by Gesell (1916) and also advocated by Irving Fisher (1933)) or (3) ending the fixed exchange rate between currency and central bank reserves (which, like all deposits, can carry negative nominal interest rates as easily as positive nominal interest rates, a solution due to Eisler (1932)).

I’ve advocated many times on this blog that monetary-fiscal hybrid policies such as money-financed helicopter drops to individuals should be established as the primary tool of macroeconomic stabilisation. In this manner, inflation/NGDP targets can be achieved in a close-to-neutral manner that minimises rent extraction. My preference for fiscal-monetary helicopter drops over negative interest-rates is primarily driven by financial stability considerations. There is ample evidence that even low interest rates contribute to financial instability.

There’s a deep hypocrisy at the heart of the macro-stabilised era. Every policy of stabilisation is implemented in a manner that only a select few (typically corporate entities) can access with an implicit assumption that the impact will trickle-down to the rest of the economy. Central-banking since the Great Moderation has suffered from an unwarranted focus on asset prices driven by an implicit assumption that changes in asset prices are the best way to influence the macroeconomy. Instead doctrines such as the Greenspan Put have exacerbated inequality and cronyism and promoted asset price inflation over wage inflation. The single biggest misconception about the macro policy debate is the notion that monetary policy is neutral or more consistent with a free market and fiscal policy is somehow socialist and interventionist. A program of simple fiscal transfers to individuals can be more neutral than any monetary policy instrument and realigns macroeconomic stabilisation away from the classes and towards the masses.

Comments

Floccina

Yes that is the question, how to get money into people's hands with the least distortion. I am not so concerned with the rich receiving the money first. They are already pay high enough taxes to cover the cost of the benefit. Transfers to individuals also may distort. How does a low income person receiving a check from government affect his views and behavior, even if he knows that it is for the purpose of Macro economic stabilization. Worse how do the politicians try to use it for their electoral benefit. In a situation like we have now a little more inflation can make debt safer and perhaps actually lower the risk premium on the debts of the working class so the rich may not even be helped the most.

Max

"If conventional QE were the only tool in the arsenal, announcing higher targets or NGDP targets achieves very little." A higher target increases expected investment return, much the same as an interest rate cut. It's true that the Fed can't threaten to lower interest rates at the zero bound, but it can threaten to leave interest rates at zero until the target is hit. And there's no limit on how high the target can be set.

RonT

Your definition of a "neutral" policy is questionable. Wouldn't a "neutral" policy not redistribute wealth? Neutral policy should be a transfer proportional to wealth and i this sense pushing up asset prices would work very well. I am not sure what it does to the signaling in the economy (why should private assets go up if the economy is the weakest, it makes no sense), but at least they are not redistributive.

Luis Enrique

" .. impact [of QE] on inflation or economic growth would be negligible in the current environment." well you're certainly in the minority of popular opinion on that one - it's striking how many people are sure QE is terrifically inflationary. If only economics were able to provide us with some firmer guidance on this question [*] I am taken aback by how many people are so sure more QE would help that they can pin the blame for our current woes on central banks for failing to have done it. If you ask me there's still far too much hand waving in between doing more QE and firms deciding to do more hiring. I'm yet to see a really convincing explanation of why more QE would help, even if I think the CB could make us expect more inflation if it tried. My preferred policy is some sort of conditional permanent expansion of the CB balance sheets, along the lines of stating that some quantity of government debt will be monetized (effectively written off) unless the economy achieves certain targets, giving governments room to spend money that won't need repaying unless their stimulus works, meaning they could afford to repay it. I like fiscal stimulus because I think it's the most direct route to increasing demand, so firms hire. I have in mind everything from public investment in infrastructure to mailing cheques. But I think we all have a tendency to think our pet ideas would work whilst looking only at the drawbacks of mainstream ideas. I have a couple of questions. First, I am under the impression central banks like conventional QE because it is easy to reverse, should they need to stamp on inflation. How do you see helicopter drops working in that regard? Second, on the idea that QE enriches the rich ... well doesn't lowering interest rates (say from 5% to 2%) also do that, yet would you object to that? And if lowering interest rates enriches the rich, does increasing interest rates impoverish them? I suppose you could say that over the long-run the central bank buys assets (conferring a gain on the holders) then sells them again at a lower price (making a loss) but that would entail central banks make losses in the long-run - is that the case? If not, I don't see how there can really be a transfer from the central bank to asset holders, in any other than a temporary fashion. [*] I know you think the theory is clear - what I mean is, economics has not produced an answer that everybody knows about and agrees with, which would be helpful

Ashwin

Floccina - The fact that the transfers are done within the framework of an inflation or NGDP target should be able to mitigate the political temptations to disburse cash in election years. But I agree that it can be a problem. Max - Announcing a target does not mean that you can hit it. My point is that conventional QE makes no difference to money supply and inflation. They can of course commit to leaving rates at zero for longer but this is much less effective when the market already expects another 3 years of ZIRP. RonT - I don't think either policy is neutral. But buying assets is essentially strongly regressive whereas helicopter drops is moderately progressive. Luis - your idea on conditional debt monetisation is interesting and would certainly work in terms of helping to hit the required target. On reversibility, the easiest way to reverse it would be a simple blanket consumption tax but there are other ways to do it and I'm not sure tightening is that hard for central banks anyway - just raise rates! On interest rates, you are absolutely right that interest rate policy can also enrich the rich and the Greenspan era when rates were cut at the slightest hint of asset-market stress is no better than QE that buys private sector assets. But it doesn't need to be this way. Thanks for the comments.

Ralph Musgrave

Ashwin, I set out some very similar arguments on my blog in March this year. Might interest you. See: http://ralphanomics.blogspot.co.uk/2012/03/sixteen-reasons-why-mmt-is-right-on.html

Max

"Announcing a target does not mean that you can hit it." Yes, but that's a much weaker statement than saying that the target doesn't matter. If the target matters at all, then you can escape the zero bound by raising the target. Why should the target matter? Because it tells you how the Fed will react. It tells you that in the event of higher inflation, interest rates will remain low, so investors will be richly rewarded, and cash holders will be severely punished. The only way this can fail to work is if investors think the Fed is playing a trick on them and will lower its target in the future, cheating them out of the profits they expected. "My point is that conventional QE makes no difference to money supply and inflation." I agree.

K

Ashwin, I told you I didn't need to take up blogging. I just wait for you to write the posts I've been thinking of. And you write so well! I'm not *totally* convinced though. The reason is that I consider asset price targeting, if done perfectly, equivalent to backing of money with capital assets, which I happen to think is a pretty good, and distributionally neutral way of creating money. The caveat is, that it is in principle impossible to target perfectly without *actual* backing. But I don't think the problem lies in the risk of the CB actually having to make purchases of assets. If they could in fact hit the target perfectly, then I don't see any obvious negative consequences. The problem comes when they miss the target, which they will, in which case there is inevitable discretion in returning the instrument to target. It is under this circumstance that there are astronomical rents to be extracted through inside information about the intentions of the CB (like we saw in the run-up to QE2). But I don't think it's a problem of asset purchases. Rather, I think it's an intrinsic problem of targeting.

K

Hey! Why am *I* being moderated. I'm very moderate.

Rajiv Sethi

Ashwin, this is a great post. I would add that another possible problem with monetary policy via asset purchases is that even if it succeeds in raising the inflation rate, it does so by changing relative prices. As bonds and equities are bid up and expected returns fall, portfolios are shifted to other asset classes including commodities, which rise in price relative to other goods and services. This can have negative rather than positive output effects, for reasons that Dan Alpert has been emphasizing. In fact you and Dan are really indispensable bloggers at the moment, since so many seemed to have jumped on the NGDP targeting bandwagon. I remain skeptical that much can be done with monetary policy right now. Wish I had more time to blog about it.

Ashwin

Ralph - Thanks. Your points on the ineffectiveness of interest rates on business investment are also worth noting. I've made similar points in an old post as well https://www.macroresilience.com/2011/09/22/operation-twist-and-the-limits-of-monetary-policy-in-a-credit-economy/ . Max - I think we've reached the limits of easing via signalling of the future path of interest rates. The market already expects 3 years of ZIRP and anything more is simply not credible. K - Apologies for the moderation. I think it's because you're using a different email id from when you last commented. It's just the wordpress default - I need to approve any new email id. I still think you should blog - your comments over at Nick Rowe'd and the debate you had on negative rates at Steve Waldman's are priceless, way too lucid and well-written to be relegated to a comments section. I'm with you on the case when the target is missed and CB discretion is involved. But even if it is hit, the bias towards propping up asset prices remains and the bias towards propping up incumbent firm assets too remains. I'm sort of aware of your ETF backing idea but I was under the impression it didn't involve any targeting? Rajiv - Thanks. That is an excellent point. I wish you would write on it - there is also the implicit assumption of not just efficient markets but smoothly efficient markets without jumps that is embedded in any market-based system of NGDP targeting. You touched upon it in a comment here http://marginalrevolution.com/marginalrevolution/2010/12/brain-teasers.html as well as the point about diversion of capital away from capital formation which is also important in my view. I also wanted to just bring some institutional detail into this debate - monetary theory needs to incorporate all the work being done on shadow banking, repo collateral etc. I don't usually find myself in a position defending central banks but the criticism they're taking right now is completely unwarranted.

Max

"I think we’ve reached the limits of easing via signalling of the future path of interest rates. The market already expects 3 years of ZIRP and anything more is simply not credible." The market expects 3 years of ZIRP because the target is too low. Raise the target and the market would immediately begin to expect higher interest rates. It is counterintuitive, but the effect of monetary stimulus (in the form of a higher inflation or GDP target) is to raise interest rates. The zero bound is not a limit on monetary stimulus. It is a limit on how low you can set the inflation target. If the target is too low, then the rate goes to 0% and stays there (see Japan).

Ashwin

Max - we're talking past each other. My point is that the threat to achieve the target (if the tools are restricted to what is currently feasible by law for the Fed) is empty therefore setting a target is pointless.

Max

I understand your position perfectly, because it's what I used to believe. Trust me that I'm not talking past you. The point of raising the target is not to convince people that interest rates will remain low longer. If the higher target increases inflation expectations, then the Fed will have to raise interest rates sooner, not later. That's because whether a particular interest rate is "tight money" or "easy money" depends on the expected inflation rate. But why should merely raising the inflation target increase inflation expectations? Simply because it makes higher inflation more likely. It's not necessary for anyone to believe that the target will be hit with certainty. The Fed can never guarantee an outcome. It can only apply carrots and sticks. A lower interest rate is a carrot. So is a higher inflation target. Both increase expected investment return. Neither offers any guarantees.

Rajiv Sethi

Max, if higher target inflation were announced and believed, the immediate effect would be on long term bond yields and not on output or employment or even actual inflation. This would immediately raise the federal deficit which is financed weekly and impose higher borrowing costs for housing and fixed investment. This contractionary effect might be outweighed over time if it results in greater consumption and investment. But through what mechanism would this happen? No business invests because it expects the general level of nominal expenditures to go up - only if it expects expenditures on its own output to rise. There is no way that the Fed can engineer a rise in inflation that keeps relative prices unchanged, so from the point of each producer, what matters is the product specific inflation rate. And there is no way the Fed can engineer a rise in inflation that keep relative prices constant. For reasons discussed above, commodities are likely to rise in price much faster than other goods and services. That is, a higher target could actually be contractionary. This, I suspect, is Bernanke's fear. Not the fear of slightly higher inflation per se, which would be a good think. People will eventually realize that the Bank of Japan was not as idiotic as they had once supposed, and that monetary policy via asset purchases has severe limitations. There is a way out of this balance sheet recession, but it required direct targeting of balance sheets and some combination of transfers and debt forgiveness. But this seems too radical a departure from conventional policy to be feasible.

Rajiv Sethi

Sorry for all the typos in the last comment... written in a rush.

Rajiv Sethi

Case in point, from Paul Krugman: "What we thought was that Japan was a cautionary tale. It has turned into Japan as almost a role model. They never had as big a slump as we have had. They managed to have growing per capita income through most of what we call their ‘lost decade’. My running joke is that the group of us who were worried about Japan a dozen years ago ought to go to Tokyo and apologise to the emperor. We’ve done worse than they ever did. When people ask: might we become Japan? I say: I wish we could become Japan." http://www.ft.com/cms/s/2/022acf50-a4d1-11e1-9a94-00144feabdc0.html#ixzz1x6nywCAa We can do a lot better than Japan, but not with monetary policy via asset purchases alone.

Steve Roth

Yeah: Nick seems to think that the threat is always credible, even absent actions. He thinks it's turtles all the way down. In a repeated game that's not true.

Ashwin

Rajiv - Thanks. That's an interesting point - depending on the asset price dynamics from the higher target, the effect on AD may even be contractionary. The tragedy is that if you put a democratic referendum to choose between a transfer or more QE, I bet the more "radical" alternative of transfers wins. Steve - Yes, it is as if perfect credibility just comes about all by itself.

The Distributional Consequences of Monetary Policy | Modern Monetary Realism

[...] is a response to an article by Ashwin Parameswaran, where Ashwin makes it clear the fed buying real world assets is fiscal policy. “A quantitative [...]

Max

Steve, raising the inflation target is an "action". It's a modification of how the Fed responds to economic data. Can it fail to have any effect? Yes, if people believe the policy will be reversed. That's the key credibility issue - not whether the Fed can guarantee a result (it can't...but neither can any policy short of full blown communism).

JKH

Very interesting post with a lot of different ideas: “Expectations are a large component of how monetary policy works but expectations only work when there is a clear and credible set of actions that serve as the bazooka(s) to enforce these expectations.” Excellent – that should be a major point of debate with the market monetarist NGDP targeters. "But for most holders of government bonds (especially pension funds and insurers), duration is not a risk but a hedge." Very valid point, especially for insurers, but not for the Chinese and other central banks. They’re not hedging duration; they’re making some sort of risk/reward long asset decision. Keep in mind also that nobody is forcing insurers to sell out of their existing hedged positions just because of QE. And new positions can be hedged by paying the market price for bonds, which in turn affects the actuarial valuation pricing for new actuarial liability positions. "More generally the negative beta nature of government bonds means that the central bank increases the risk exposure of the economy when it buys them." I haven’t looked at this argument closer as it was presented on the Rowe post, but I find it unconvincing on first go through quick and dirty. The fact that bonds can be used as a beta hedge for equities doesn’t mean equities will respond to the removal of bonds for that reason. There are $ trillions in long only equity investment that are unrelated to such beta hedges. This strikes me as an exaggeration of the marginal. "The liquidity preference argument is redundant in differentiating between deposits and an asset that qualifies as safe collateral." Yes, except that the effective liquidity of a position is also a partial function of interest rate risk – i.e. the willingness to sell may be overridden by the aversion to loss taking in certain categories of portfolios. Interestingly, MMT relies a lot on this liquidity argument for its own purposes. "The very act of making private sector assets “safe” is a transfer of wealth from the taxpayer to some of the richest people in our society." I’d like to see this clarified a bit more. The swapping of private sector assets for QE reserves is in fact a transfer of expected wealth to the taxpayer. This effect shows up in the increased Fed profits that have been remitted to Treasury. The other effect, which I think you’re referring to, is the impact on the value of market assets that aren’t swapped. Keep in mind that the universe of unswapped assets will typically be huge by comparison, and that expected commitments aren’t generally for the “entire world”. The other thing I wonder about is that the capital gain due to duration, at least on fixed income instruments, becomes an issue of recognizing income and value earlier instead of later. It is zero sum in that sense. I haven’t thought through how that should work for equities. The explicit nature of the central banks’ stabilization commitment means that the rent extracted from the commitment increases over time as more and more economic actors align their portfolios to hold the stabilised and protected assets." If you take that to the Sumnerian limit, there are ever fewer market assets left to enjoy that rent extraction. Meanwhile, the central bank is remitting a hyper-fortune to the Treasury and the taxpayer. "Central-banking since the Great Moderation has suffered from an unwarranted focus on asset prices driven by an implicit assumption that changes in asset prices are the best way to influence the macroeconomy." There’s no obvious reason to restrict the analysis to the great moderation. How would you interpret the Volcker tightening in the same context of the effect on income distribution and creditors in particular? What is it about your argument that validates an asymmetric secular analysis? Just a few quick thoughts. Excellent post though.

K

Max: "raising the inflation target is an “action”" Then *I* hereby raise the inflation target. I can't do that? Why not? JKH: "The fact that bonds can be used as a beta hedge for equities doesn’t mean equities will respond to the removal of bonds for that reason." I think Ashwin's negative beta argument is correct (I think I invented it!). What matters is not whether most stocks are held with bonds, but whether most bonds are held with stocks. Apart from central bank holdings, I think it's very much the case that most treasuries are held in large superannuation portfolios managed for maximum diversification benefit by professional managers who are extremely well aware of the correlations. I don't think bonds are always negative beta, but I think the correlation with equities is especially negative when demand is deficient and the market is desirous of more inflation. I think that was definitely the case when Operation Twist was announced. 2s/10s flattened, so it was definitely unexpected and *yet* stocks fell on the announcement. I can't think of any other reasonable explanation. I think there's a case for a separation of Operation Twist into two separate actions for discussion purposes: 1) Purchase of duration, with a change in the future short rate policy to neutralize the impact on the yield curve 2) Reversal of said change in future short rate policy Then we can discuss the impact of treasury purchases on investment portfolios independently of the effect of yield curve policy on investment/saving behaviour.

Steve Roth

@Max: "Steve, raising the inflation target is an “action” So if the Fed promises to promise to do something, is that an "action"?

Ashwin

JKH - Thanks! Agreed on the point about risk exposure of CB bond-holders. The negative beta point is indeed K's. On the transfer of wealth point, I am indeed talking about the impact on non-swapped assets. As you mention - the issues in bond prices going up aren't that important. If nothing else, there's a logical upper bound which we're already close to hitting. The issue is what this change in relative prices does to other real and/or long-duration assets like equities, real estate, commodities etc. If you elevate the price of one asset, then the change in relative price structure (ceteris paribus) necessarily means an increase in other asset prices. My basic point is just that any regime that focuses on asset prices is itself regressive in nature - a cursory look at wealth distribution by income percentile tells us that. On the Sumnerian limit, my intuition is similar to yours but I'm not yet fully convinced. Market monetarists obviously argue that the limit of a credible commitment is no intervention but if the commitment is even imperfectly credible then the system can easily spin to another equilibrium where the CB owns all assets under its commitment-list over the long run. Once the CB is the key marginal player that sustains prices that are higher than would be the case without its presence, then any doubt about how long the commitment can last will tempt market players to hit the CB bid and exit. The limit here is a state-owned economy. But I'm still not completely convinced by my own argument. On limiting it to the Great Moderation, I just don't know enough about the previous period to be convinced. From what I've read about Bill Martin's tenure at the head of the Fed in the 50s I got the impression that the asset-price focus is a newer phenomenon.

Luis Enrique

here's an argument (which I confess I don't completely follow) for using fiscal stimulus to make QE have an impact in current circumstances by making permanent monetary expansion credible. At least I think that's the idea. http://delong.typepad.com/sdj/2012/06/a-fragment-on-the-interaction-of-expansionary-monetary-and-fiscal-policy-at-the-zero-nominal-lower-bound-to-interest-rates.html

Asymptosis » Turtles All the Way Down: Are Fed Promises “Actions”? How About Promises to Make Promises? Game Theory Edition

[...] frequently brilliant Ashwin Parameswaran makes The Case Against Monetary Stimulus Via Asset Purchases, and Nick Rowe responds. Ashwin replies, analyzing “monetary policy as a threat [...]

Max

"Then *I* hereby raise the inflation target. I can’t do that? Why not?" You don't control the Fed Funds rate! Again, I'm not say that by setting a target the target is guaranteed to happen. I'm saying that the target makes some possible futures more likely, and this changes behavior in the present.

Max

Here's another way of putting it: there's a possible future in which the economy forever undershoots the Fed's target. There's no way to rule this out. It's just not a *likely* future provided that the Fed is really committed to never lowering the target in the future (and that's the rub: perfect commitment isn't possible).

Ashwin

Luis - Thanks. Brad DeLong's idea is more along the lines of using a fiscal commitment to make the monetary expansion more credible. Interesting idea and not without merit.

K

Max: "You don’t control the Fed Funds rate!" Exactly! The limit of my power is to tell everyone what I plan to do using the actions I control. The fed controls the fed funds rate and the quantity and duration of treasury bonds on its balance sheet. It can talk about what it plans to do with those things and under what circumstances. Changing an inflation target is exactly such "talk" and the limits of its usefulness are given by the maximum possible effects of the things the Fed can actually *do* (like announcing that the fed funds rate will be zero forever).

Max

"Zero forever no matter what" is consistent with any inflation rate, including hyperinflation, so a responsible central bank would never promise that (and would not be believed if it did). What the central bank is saying with its target is: we will set the bank rate consistent with hitting the target, as best we can. If the target is too low, then you may hit the zero bound. In that case you should either remove the zero bound or raise the target. A crazy central bank could keep interest rates at 0% forever by manipulating the inflation target. That's basically what the Bank of Japan is doing. But note that this requires the threat of raising interest rates, even if it never actually happens.

K

Max: "“Zero forever no matter what” is consistent with any inflation rate, including hyperinflation" *Any* path of rates will cause asymptotic hyperinflation or deflation depending on the initial state of the economy. Assume an economy with a stable 2% natural rate and inflation expectations flat at -3%. There is nothing the bank can do to save this economy from depression. Even a permanent zero rate policy leaves the initial real rate 3% which will then spiral upwards. It's not a "crazy" policy. It's the best they can do for that economy, but it's not enough. There's nothing the cb can do with expectations management because equilibrium is not within reach of the possible paths of their instrument.

Max

K, the problem is assuming that inflation expectations can be stable at a rate far from the target. Expectations are naturally unstable, so they can only stabilize at the target, nowhere else.

K

No. The problem is that there is nothing the cb can do to stabilize that economy. The target is no more powerful than the limitations of the instrument.

Max

The power of the target is that it's the only stable state. Every other state is temporary, because there's nothing forcing the economy to remain in those states. So my view is that a CB can always escape the zero bound by raising the target. It may have to raise it more than it would like - maybe more than is politically feasible. That's certainly a potential problem.

K

Are you saying that the target is stable *because* it's the target? This is simply wrong in any model I've ever seen or that has any coherent relationship to reality. The target is stable *if and only if* it keeps the real rate at the natural rate. Period.

Max

Let me back up and try again. If everyone believes that it's impossible for inflation expectations to increase on their own, without the push of a lower bank rate, then I would agree that merely announcing a higher target won't do anything. But if higher inflation expectations are believed to be possible (again, without the CB doing anything), then a higher target will increase expected inflation. That's because the CB is promising to set the bank rate below the equilibrium rate if/when that becomes possible. That's something it can do.

J.

Great insight. I would add that helicopter drop is essentially a fiscal policy action ie lowers effective taxes. My preferred policy, if the drop can be distributed somewhat equally ie also to those indebted who are currently not paying taxes. Just to note that this would make sense in terms of economic growth as those people are more likely to use the money. Economy is not a morality game.

joe bongiovanni

While the case against the creation of gobs of additional monetary assets for the holders of existing monetary assets might seem controversial for some reason, in fact what NEEDs discussion is the alternative method for achieving growth without either QE or more debt. The means for achieving that end is presently before the Congress Assembled as H.R. 2990, the Kuciniich Bill for transforming from the present debt-based system of transitory bank-credit money to a system of permanent non-debt based money of public issuance. http://www.monetary.org/wp-content/uploads/2011/10/HR-2990.pdf Time to stop crying about what's wrong with the impotent Fed and start talking about what's possible, if we want it. For the Money System Common

Lawrence D'Anna

"The Bank of England and the Federal Reserve could buy up the entire outstanding stock of govt bonds and the impact on inflation or economic growth would be negligible in the current environment" If this were really true, then why on earth would we even consider not doing it? Either QE puts the economy back on track, or it wipes out the entire national debt? Sounds like a win-win to me.

Ashwin

Lawrence - for a very long explanation of why that is the case, try my new post https://www.macroresilience.com/2012/10/17/monetary-and-fiscal-economics-for-a-near-credit-economy/

On The Folly of Inflation Targeting In A World Of Interest Bearing Money at Macroeconomic Resilience

[...] my earlier post ‘The Case Against Monetary Stimulus Via Asset Purchases’ for why I oppose such a policy. [...]