The Reality of Abenomics: Qualitative Easing and Propping Up The Markets

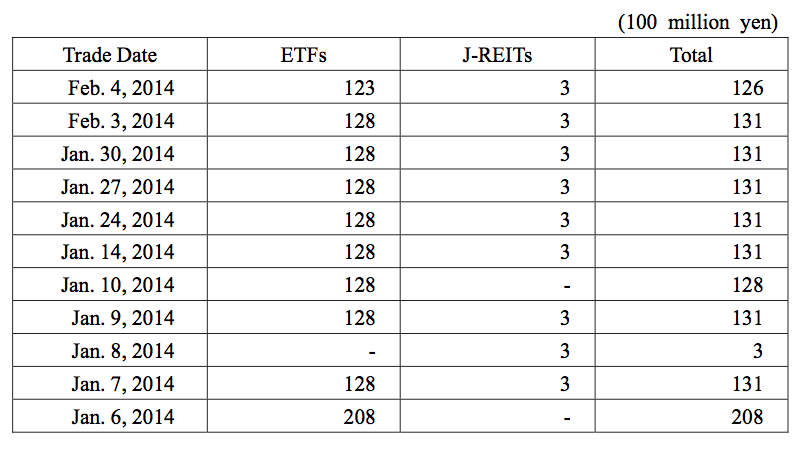

Noah Smith and David Andolfatto think that Abenomics conclusively proves that quantitative easing boosts inflation. But Abenomics has nothing to do with quantitative easing and everything to do with qualitative easing. Every week, the Bank of Japan (BoJ) purchases Topix and Nikkei 225 ETFs till it hits an annual limit of around 1 trillion yen (see table below for last month’s purchases). It also purchases a much smaller amount of real estate investment trusts (REITs). Abenomics has nothing to do with increasing the “money supply” and everything to do with propping up asset prices.

How does the BoJ decide when to buy ETFs? It is widely believed that they follow the ‘1% rule’ i.e. “it would buy ETFs when the Topix index of all issues on the first section of the Tokyo Stock Exchange fell more than 1% in the morning session”. Abenomics takes the Greenspan/Bernanke put to its logical conclusion - why restrict monetary policy to implicit protection of asset prices when it can serve as an explicit backstop to the stock market?

What is the end-game of Abenomics? Obviously buying ETFs and REITs will increase inflation. But advocates of qualitative easing argue that such purchases will be a temporary policy that will be unwound when the economy achieves ‘lift-off’. This is pure fantasy. The BoJ will have to keep upping the ante to maintain even a small positive rate of inflation in a demographically challenged economy such as Japan. Already the ‘1% rule’ is no longer sufficient: “In the latter half of 2013, the bank apparently relaxed that rule, sometimes buying even when the decline was less than 0.5%”. In the long run the BoJ will end up owning an ever-increasing proportion of the private sector financial assets in the Japanese economy.

There is no lift-off, just an ever-increasing cost of intervention for the central bank and a correspondingly increasing drug addiction for the private sector.

Comments

Sid

Do all demographically challenged (or at least ones where the Saving Class have a disproportionate say in their politics) economies end up following a monetary policy arc of propping up asset prices? Anecdotally, the UK seems to be following suit. Though, we've yet to see Carney making calls to Winkworths to enquire about Chelsea house prices.

Ashwin Parameswaran

Sid - in the conventional paradigm where fiscal easing is not an option, propping up asset prices is the only other way out. The current UK recovery is completely driven by a subsidy-driven recovery in housing prices. Obviously simple helicopter drops could do the job and it is the option that I support.

Max

When you say that the BOJ is "propping up asset prices", do you mean to imply that the BOJ is overpaying? Or is any purchase a "propping up" even if the assets are undervalued?

Ashwin Parameswaran

Max - I only mean that the price of Japanese equities is higher now than it would be in a world where the BoJ did not buy equity ETFs.

Max

Ok. But doesn't the merit depend on whether the purchases are pushing the stock market toward equilibrium (hastening the inevitable) or away from it (postponing the inevitable)?

Ashwin Parameswaran

It is impossible to answer that question conclusively right now. The test will simply be whether the stimulus can be withdrawn without causing the markets to fall. As my post makes clear, I don't think it can be withdrawn. A counter-example would be the 2008 lender of last resort intervention by the Fed which was unwound quite easily without causing any market disruption.