Capitalism For The Masses

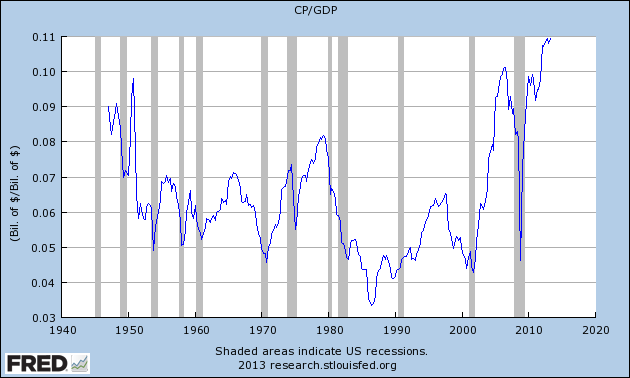

The post-2008 economic recovery has been a recovery of the capitalists. Growth in employment and real wages has been sluggish whereas profits have rebounded well past pre-recession highs. However, the decline of the share of labour in GDP is not a localised post-crisis phenomenon. It is a global phenomenon that started at least three decades ago. The Great Moderation has been a period of stable prosperity for the capitalists and a period of stagnation for labour.

The declining share of labour in national income is not a problem by itself. The underlying problem is the stagnation of real income experienced by the masses. One way to tackle this problem is to redistribute income away from high wage-earners and large capitalists towards the low and medium wage-earners. But this approach is a losing battle against the march of technological progress and the inevitable substitution of labour by capital. Instead we should empower the low and medium wage earners of today to become the capitalists of tomorrow whilst protecting them with a safety net that protects them as individuals rather than protecting the firms and unions that they are members of.

There are two reasons why a ‘capitalism for the masses’ is a viable proposition today. Entrepreneurs need less capital to start a viable business today than they did in the twentieth century and whatever capital they do need is much more freely available today than it has been in the past.

Entrepreneurs need less capital

Economies of scale and scope are collapsing across the economy. This has been the case for many years in the world of software. But it is also increasingly true for hardware. The advantages of the small player can overcome the cost disadvantage of operating at a lower scale. The agile small player can experiment and iterate in a manner that the large incumbent player cannot. As Luke Johnson observes in the case of the craft beer industry, the customisation and unique character of the smaller producer is well worth the small premium for many customers.

Throughout the ‘Control Revolution’, larger firms enjoyed a significant cost advantage over smaller players and oligopolies were the norm In most manufacturing sectors. Chris Anderson narrates the story of his grandfather who was an inventor during the heyday of large conglomerates in the 20th century:

he was an inventor, but he could not become an entrepreneur because those additional steps of mass production, distribution, marketing, et cetera, were essentially inaccessible in those days. All you could do was patent, license and hope for the best. You had to lose control of your invention. You had to hand it off to somebody else.

On the other hand, an inventor today has a multitude of options to prototype and produce small quantities of his product. The logistics of selling and delivering the product to customers are also easily outsourced. As Luke Johnson identifies, the dynamics of capitalism “appear to be coming full circle and reverting to a structure that prevailed at the start of industrial capitalism” in the early part of the nineteenth century.

Capital is freely available

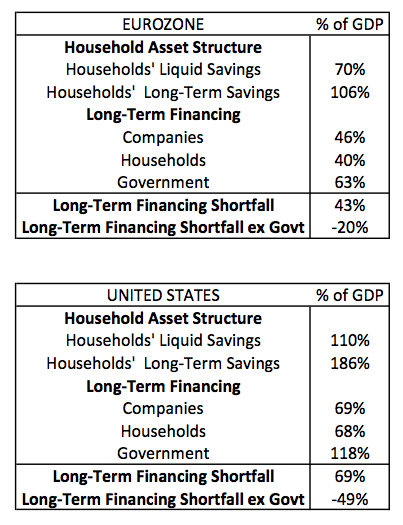

In our increasingly ageing and wealthy society, there is no shortage of capital available to fund new businesses. Household savings alone is sufficient to fund the required business investment1.

We imagine that risky businesses can only be funded by the alchemy of modern maturity-transforming banking system. But as I showed in my last essay, the explosion of peer-to-peer financing in the United Kingdom today shows us that speculative equity ventures and business loans can and are being funded by the man on the street.

Although significant progress has been made recently, many of the hurdles to achieving a genuinely decentralised financial system are regulatory. By trying to protect small investors from the consequences of investing in a failed venture, we end up denying financing to small businesses. It is insane that we allow small investors to “gift” as much money as they want on Kickstarter but we limit them from investing in the same venture as a part-owner with the legal protections against fraud afforded by being an owner.

Deregulate and Expand The Safety Net

Throughout the industrial era, most people did not have the option of becoming a capitalist. If you worked in a manufacturing plant, your best option was to join another firm. This is still the case today. But in many industries, the only thing stopping laid off employees from striking out on their own are regulatory economies of scale and protections (such as bailouts, patent protections and licensing requirements) that large incumbent firms enjoy. In order to enable every person to become a capitalist, we need to reduce the regulatory burden on all aspiring capitalists as well as removing the protections enjoyed by incumbent large firms.

At the same time that we eliminate these localised firm-focused safety nets, we need to implement a a broad-based safety net for individuals that will help mitigate the greater uncertainty of such an economic system. Every individual should be assured of access to an income that affords him the basic necessities of life, access to catastrophic healthcare protection and access to basic financial services such as the ability to hold a bank account and make payments.

However, no one is entitled to protection from the inherent instability of a competitive capitalist economy. Firms and workers should not be protected by bailouts. Individual investors should not be protected from the risks of investing their money in failed ventures. Everyone deserves a safety net but no one deserves a hammock.

The expanded safety net and increased deregulation go hand in hand. Increasing instability without a safety net will make the system more fragile. And a broad-based safety net by itself will simply dovetail with localised safety nets to reinforce an already sclerotic and stagnant economic system. By combining the two, we can achieve the best of both worlds - a robust economic system that can achieve disruptive economic progress whilst protecting individuals from the worst consequences of economic failure.

Note: For a more detailed explanation of my approach to economic policy and its rationale, see my earlier essay ‘Radical Centrism: Uniting the Radical Left and the Radical Right‘

Comments

Rahul

Ashwin- I think it's a well written essay and I agree with most of your points made here, but from what I have seen, Kickstarter works more as a pre-ordering system (thus solving working capital problems for new and experimental projects) rather than a gifting system. This also means that amounts pledged per backer are much smaller than they would be if it were to be an investment platform.

David Bofinger

The people most likely to made unemployed by capital-intensive substitutes are not the people most likely to be successful entrepreneurs. This is not a good mechanism for saving those who need saving.

Ashwin Parameswaran

Rahul - Thanks. Kickstarter is a pre-order with effectively no commitment which is tantamount to a gift. There is no reason why mass ownership cannot be achieved with equally small amounts. If someone wants to invest larger amounts, then surely it is their responsibility to make sure that they are able to take on the financial loss if things go sour. And moreover this is why the safety net is so important. If things do go catastrophically wrong, then you are protected.

Ashwin Parameswaran

David - when I talk about entrepreneurs, I'm not really talking about the people who will found the new Apple or Facebook. I'm talking about the small farmers, street-cart food providers, hairdressers etc who are today prevented from starting up their own small-scale business due to the regulatory costs of doing so.

Rahul

Ashwin, in response to your points above: Paying money with strong expectations of getting something tangible in return is hardly tantamount to a gift. Not sure about the legal enforceability but at least there is a strong social contract. Agree with your point that you could have very small amounts invested as equity. The problem is of judging how much to pay - equity is very hard to value, especially for startup businesses; products are much easier. As to the point about people investing larger amounts and being responsible for it, I think that would only work for people with money to spare (the JOBS act gets this right).

Brett

I do like the idea of a basic income and health coverage set-up that's available to everyone. It would be sort of like how we (at least ideally) guarantee a certain degree of police and firefighter coverage to everyone regardless of how much they pay in property taxes - namely, a "floor" on how far people could fall in the wake of failure. There's no reason we should have them fall into starvation and complete destitution. @David

I don't think most of them would actually be entrepreneurs on their own, but with stuff like the JOBS Act, they could invest in said entrepreneurs.Anthony

The JOBS Act that was enacted in 2012 was meant to liberalize equity funding and foster the kind of crowdfunding portals you describe. There are obviously risks involved in this shift, but there is some potential in this framework for democratizing access to a variety of capital projects. (see, e.g. http://www.cnbc.com/id/101054808) The SEC is still involved in rulemaking under the statute, which I have been following here: http://www.mofojumpstarter.com/

Ziad K Abdelnour

What is wrong with Capitalism Today? Capitalism works for capitalists. Problem is 90% of Americans are not capitalists, they are employees. Most of their 'capital' is tied up in housing, the rest in non-performing stocks. Median household net worth is the same now as in 1990 -- $77,000. Since 1979, average income of the bottom 90% declined $900, while that of the top 1% increased $700,000

stone

I'm totally in agreement with this idea of needing to get the economy owned by and run by everyone. One additional thing that I've thought would help towards that end would be to replace current taxes with an tax on gross assets -then continued financial control would depend on being able to maintain an accumulation of wealth by getting it to earn enough to pay the tax. I think small aggressive disruptive start ups would be much more likely to make inroads. Under our current system there is massive political power behind simply maintaining the value of existing financial assets even if that means stagnation.

Money demand that doesn’t raise interest rates | direct economic democracy

[...] Capitalism for the masses- Ashwin Parameswaran [...]

The solution to income inequality and immobility? It’s been right in front of us all along | AEIdeas

[...] and current entrepreneur Ashwin Parameswaran offers this alternative to redistribution, which he succinctly and brilliantly summarizes thusly: “Instead we should empower the low and medium wage earners of today to become the [...]

Steve Roth

From one entrepreneur to another: Another great post. Just one comment: "we should empower the low and medium wage earners of today to become the capitalists of tomorrow whilst protecting them with a safety net that protects them as individuals" That's redundant! Protecting them increases the risk-adjusted return on leaving their job and trying a startup (if by risk we mean actual, personal risk). Or put more humanly and personally: I started the most successful and riskiest business I ever started shortly after receiving a small six-figure inheritance. Knowing that I and my kids would be okay if I failed gave me the psychological space to do it. (Sold it nine years later for high seven figures.)

Ashwin Parameswaran

Steve - Thanks. The second part of that sentence is better put as "protect them as individuals rather than protecting the firms they work for" which is the current approach and is, in my opinion, incredibly damaging.

Steve Roth

Right. I'd change "whilst" to "by."

Government vs. Startup America: Starting a craft brewery in US as tough as starting a small business in China or Venezuela | AEIdeas

[...] must become direct capitalists. Entrepreneur Ashwin Parameswaran offers this alternative to redistrubution: “Instead we should empower the low and medium wage earners of today to become the capitalists of [...]

Capitalism for the Masses | AccidentalCapitalist

[...] Capitalism For The Masses makes me nervous and squirm about. It’s a well thought out proposal. I like the idea of increasing the pool of capitalists by reducing the barriers to entry. And by reducing the average size of businesses, much of the social contract will be restored. It’s much easier or safer to shaft workers on the other side of the world than workers on the other side of town. [...]